Discounted cash flow calculator online

CAPM and Actual. The calculator below can be used to estimate Net Present Wort - NPW - in an investment project with up to 20 periods and variable cash flows.

Present Value Of Cash Flows Calculator

Learn to calculate or make a DCF with discounted cash flow valuation example.

. Present Value - PV. With these components in mind the discounted cash flow formula is as follows. NPV is used in capital.

Free cash flow Give yourself a margin of safety by being conservative in your earnings assumptions. Wikipedia defines the MIRR as. Usually a company or individual cannot pursue every positive return project but NPV is still useful as a tool in discounted cash flow DCF analysis used to compare different.

So we have just prepared this Payroll Calculator Excel Template in order to make this process a bit easier for you. The income approach the cost approach or the market comparable sales approach. The discounted cash flow uses the Free cash flow of the company to forecast the future FCFs and discount rate to find its present value.

Rental property investment failures can be caused by unsustainable negative cash flows. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. 385 Normalized Earnings.

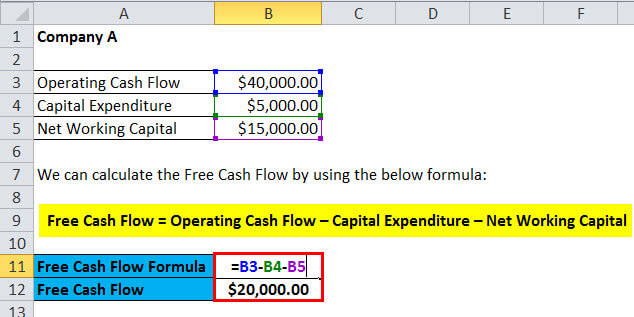

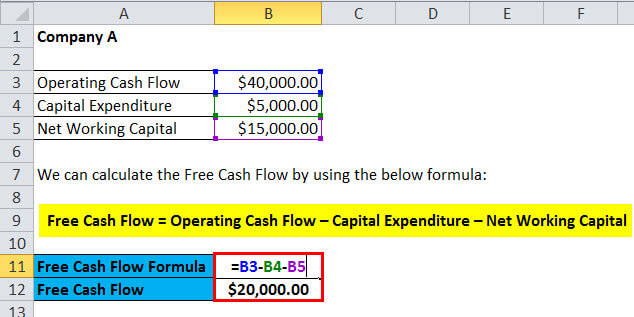

You can use the following Free Cash Flow Formula Calculator. In a calculator or computer E or e which stand for exponential are employed to denote the power of 10. 533 Average CF yield last 10 years.

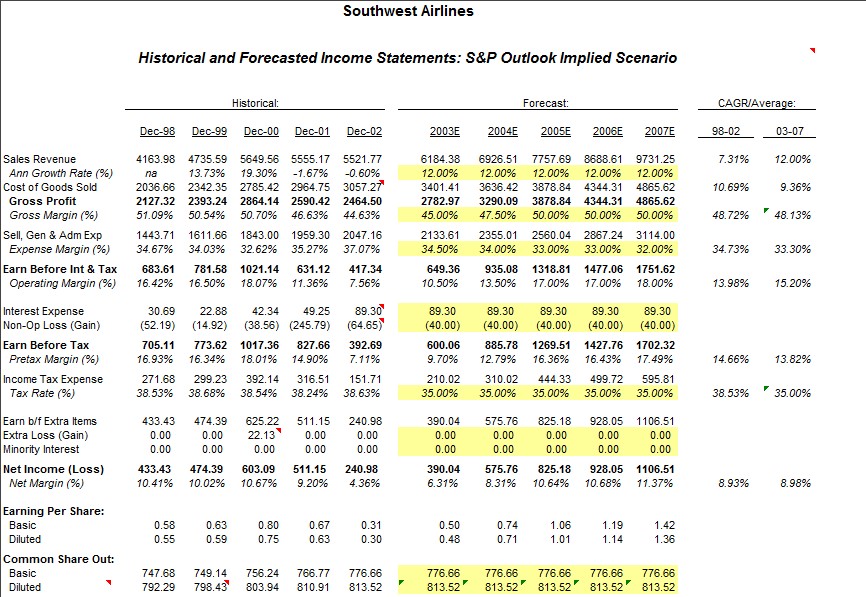

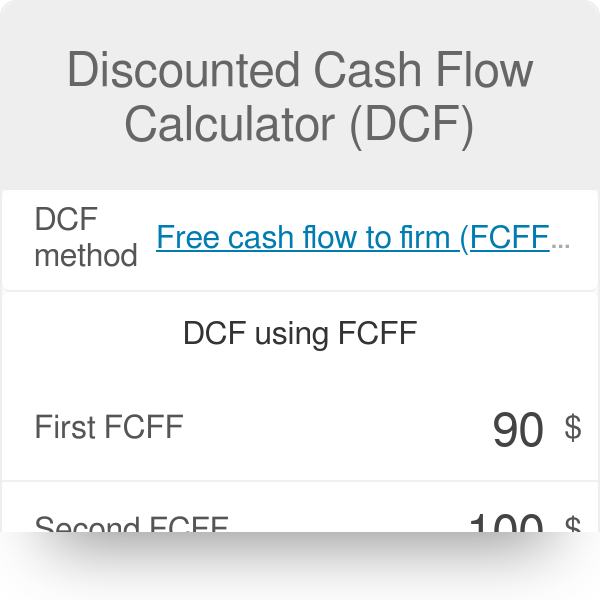

By adding the companys free cash flow to firm or the earnings per share to the discount rate WACC we can find out if the current price of a security or business is cheap or expensive. Net Present Worth Calculator - Variable Cash Flow Stream. Discounted Cash Flow DCF Model is a financial model used for business valuation.

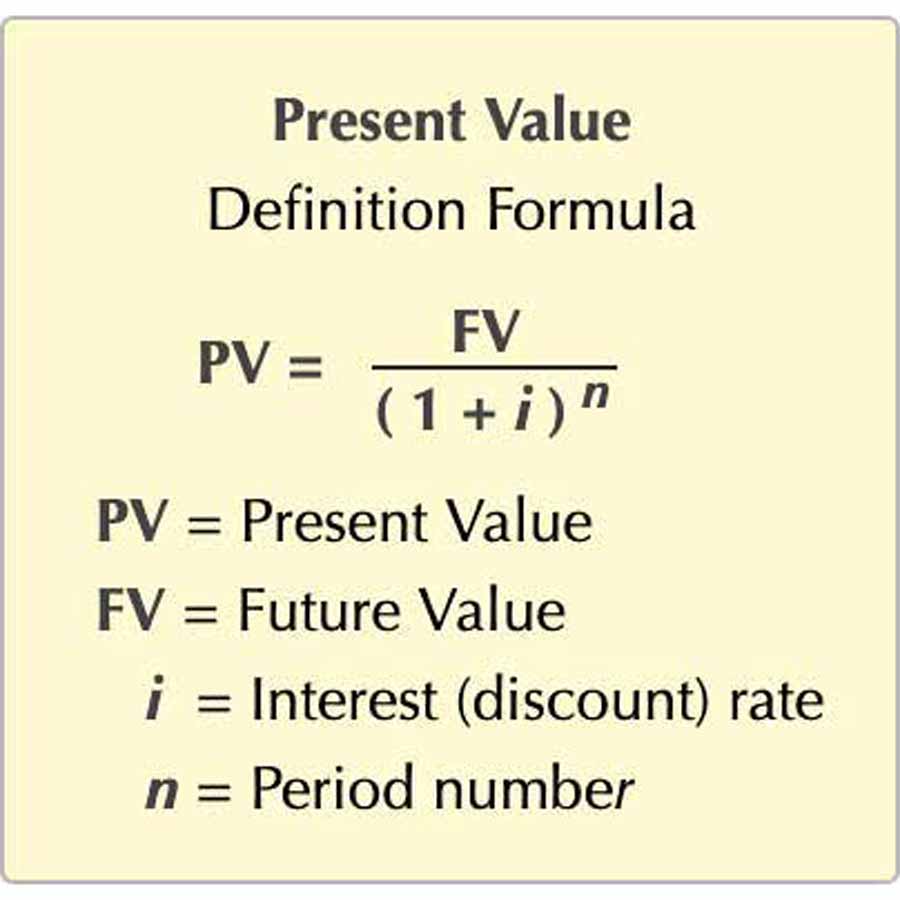

This rate of return is discounted from the future cash flows. Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Very nicely made fin read more.

The formula adds up the negative cash flows after discounting them to time zero using the external cost of capital adds up the positive cash flows including the proceeds of reinvestment at the external reinvestment rate to the final period and then works out what rate of return would cause the magnitude of the discounted negative cash flows at time. The rate at which a liquid flows will vary according to area of the pipe or channel through which it is passing and the velocity of the liquid. DCF is a popular absolute stock valuation calculation technique to find the intrinsic value of the stocks.

Higher DPOs result in more near-term liquidity ie cash on hand. We discount our cash flow earned in Year 1 once our cash flow earned in Year 2 twice and our cash flow earned in Year 3 thrice. Generally having adequate cash reserves is a positive sign of financial health for an individual or organization.

By Jason on Aug 23 2022. Operating Cash Flow. Discounted Cash Flow Calculator Business valuation BV is typically based on one of three methods.

Among the income approaches is the discounted cash flow methodology that calculates the net present value NPV of future cash flows for a business. However calculating the taxes earnings and other items is no fun. Use this online calculator to easily calculate the NPV Net Present Value of an investment based on the initial investment discount rate and investment term.

Future cash flows are discounted at the discount. How to calculate discounted net present value in a typical renewable energy project. 542 Trailing 12 month cash yield.

Discounted Cash Flow Excel Template. The longer a payment is delayed the longer the company holds onto that cash. E Notation E notation which is also referred to as exponential notation is like scientific notation in that it involves multiplying a decimal number between 1 and 10 by 10 raised to a.

By setting up a table like the ones above you can quickly discount each cash flow and sum them. Discounted Cash Flows Calculator. DCF valuation spreadsheet in Excel.

Cash Flow Return on Investment CFROI is a metric for this. Cash Flows Per Year. Once your sum equals zero you have an accurate IRR for the project.

By reading this article you will understand what the. Since an increase in an operating current liability such as accounts payable represents an inflow of cash companies strive to increase their DPO. Many times if you are using this approach it may be easiest to work in a spreadsheet where you can quickly adjust your rate.

The table is structured the same as the previous example however the cash flows are discounted to account for the time value of money. Using the Online Calculator to Calculate Present Value of Cash Flows. With time you will get close.

While bills must eventually be paid for now the. Oftentimes cash flow is conveyed as a net of the sum total of both positive and negative cash flows during a period as is done for the calculator. Sometimes called Cash-on-Cash Return CFROI helps investors identify the lossesgains associated with ongoing cash flows.

517 Net cash yield. Net Present Value - NPV. Other than FCF dividends or EPS are also widely used to find the discounted cash flow.

Rated 480 out of 5. Implied ERP annual from 1960 to. Go for an automatic tool to calculate PV of cash flows if you want to be sure that your calculations are quick and precise.

Elaborative revenue collection drivers. What is Volumetric Flow Rate. Implied ERP in previous month 526 Trailing 12 month with adjusted payout.

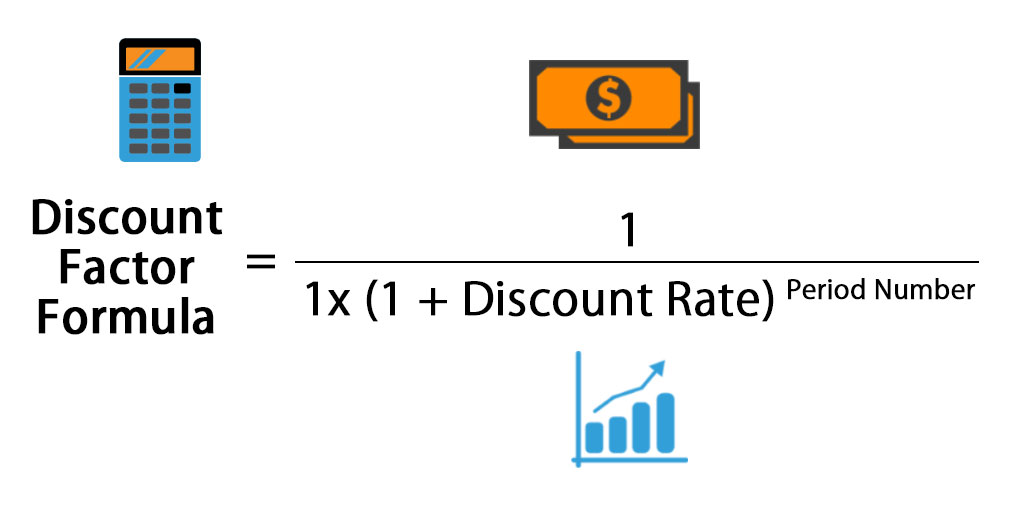

Here each cash flow is divided by 1 discount rate time period. SaaS Quick Ratio Excel Template Calculator. The discounted cash flow calculator is a fantastic tool that investment analysts use to determine the fair value of an investment.

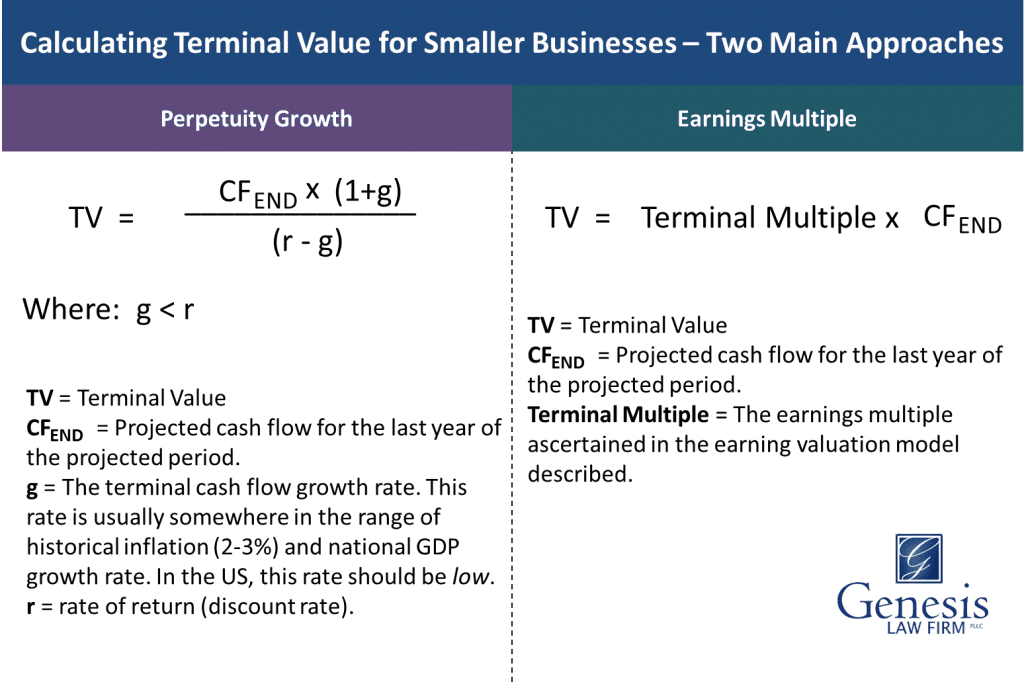

In particular its. The volumetric flow rate which is also commonly referred to as the rate of liquid flow or volume flow rate is the volume of a given fluid that flows within a unit of timeIt is usually denoted by the Q symbol. The Discounted Cash Flow method uses Free Cash Flow for a set number of years either 5 10 or so on and then discounts those cash flows using the Weighted Average Cost of Capital to reach a certain valuation for the company.

But other than this distinction the calculation steps are the same as in the first. This means the higher the discount rate the lower the present value of future cash flows. Electric Car Company Financial Model.

Since cash flow is associated with a specific time period the period number represents a year quarter or month that youre trying to determine the discounted cash flow for. Estimate value of future cash flows. The study of cash flow provides a general indication of solvency.

You can find company earnings via the box below. Free Cash Flow Formula Calculator. Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time.

DCF Sum of cash flow in period 1 Discount rate Period number. Example - Investment In Renewable Energy - Discounted Cash Flow. The other cash flows will need to be discounted by the number of years associated with each cash flow.

This calculator finds the fair value of a stock investment the theoretically correct way as the present value of future earnings.

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Dcf Model Full Guide Excel Templates And Video Tutorial

Discounted Cash Flow Calculator Calculate Dcf Of A Stock Business Investment

Free Cash Flow Formula Calculator Excel Template

How To Calculate Discounted Cash Flow For Your Small Business

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

Discount Factor Formula Calculator Excel Template

Discounted Cash Flow Dcf Definition Analysis Examples

Discounted Cash Flow Analysis Study Com

Excel Discount Rate Formula Calculation And Examples

How To Use Discounted Cash Flow Time Value Of Money Concepts

Discounted Cash Flow Calculator Dcf

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

Mid Year Convention Discounting Adjustment And Calculator Excel Template